What is this article about?

The PAY360 survey findings on key opportunities and challenges in the payments industry, including AI, real-time payments, and regulatory issues.

Why is this important?

It guides stakeholders in navigating the evolving payments industry to innovate, compete effectively, and enhance consumer services.

What’s next?

Leaders can leverage the findings to prioritise technology adoption, enhance regulatory compliance, and strengthen cybersecurity measures, ensuring their strategies align with the latest industry trends and consumer expectations.

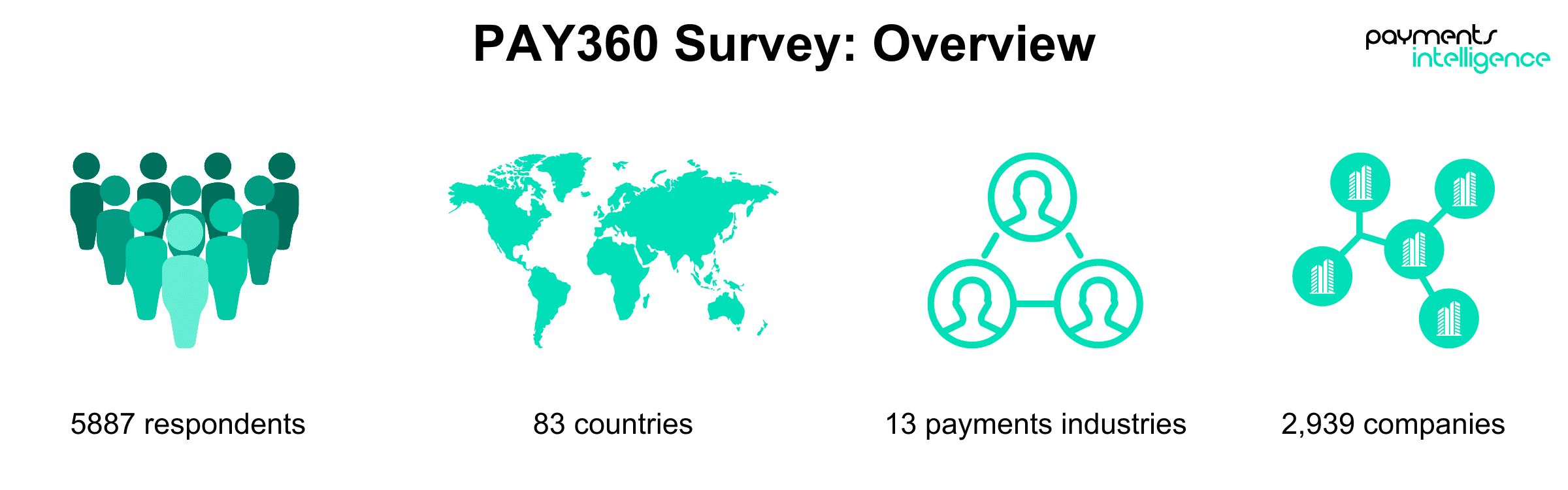

In the ever-evolving payments space, understanding the currents that shape its trajectory is paramount for leaders navigating its complexities. Fresh data compiled by The Payments Association (TPA) collected from nearly 6,000 pre-registrants to PAY360, the largest dedicated payments conference, sheds light on the opportunities and challenges facing the payments industry. From the persistent spectre of financial crime to the transformative potential of open banking.

Pre-registrants also identified their preferred topics of interest, covering some of payments’ most pressing areas, such as financial crime, cross-border payments, and digital currencies. This is the first instalment of an exclusive Payments Intelligence series to unpack key trends across the payments industry and personas.

The data, which represents the views of a diverse array of industry stakeholders, including C-suite executives, company founders, and regulatory bodies, provides a comprehensive and reliable source of insights for strategic decision-makers to ensure they’re making the most of 2024 and what it could hold for their business.

In the PAY360 survey, payments professionals selected artificial intelligence (AI) (16%) and cross-border payments (11%) as the two most fertile grounds for deciding which areas present the most fruitful opportunities for payments firms in 2024.

The growth of AI technology has profoundly impacted the payments space, as KPMG‘s Michelle Plevey points out. According to Plevey, APIs/EMIs can use AI to analyse large amounts of data, such as customer complaints, to identify patterns and detect consumer harm. Similarly, converting consumer behaviour into business intelligence can help determine if a product is meeting its target market’s needs.

“Consumer behavioural patterns, if converted into business intelligence, can help articulate that a selected product is effectively addressing the needs of its target market, as set out during the product design stages,” she says.

Cross-border payments are also seen as a springboard to growth. As global economies continue to work closely together, the demand for seamless transnational transactions surges. Traditional barriers, characterised by high fees and opaque processes, are being broken down as leaders recognise the need for a more transparent and efficient cross-border payments network. TerraPay’s co-founder and general counsel, Akbar Hussain, argues that cross-border payments are vital for the global economy to thrive.

He says: “Over the last few years, this ecosystem has been shaken by shifting consumer expectations, large-scale digitisation, emerging technology, global trade expansion, and a dynamic global regulatory landscape. And frankly, the industry has kept pace.”

Findings from the TPA's PAY360 survey revealed that 10% of respondents are betting on real-time payments to make a significant difference in the near future. This suggests that industry professionals recognise the transformative potential of real-time payments and are positioning themselves to capitalise on this trend.

According to data from AutoRek's global payments manager, Nick Botha, 85% of payments firms globally are expected to be ready for real-time payments within the next 12 months. He says, "This fast pace of adoption aligns well with the introduction of real-time payments infrastructure. With the recent launch of the Federal Reserve’s FedNow service and the UK’s plans to enhance its real-time infrastructure, the future of real-time payments is more promising than ever."

The data, which was pulled from a survey conducted by AutoRek, indicates a widespread industry shift towards adopting real-time payment infrastructures, reflecting the growing demand for faster and more efficient transaction processing.

Notably, a small but proactive segment of firms has already taken steps to embrace real-time payments, with 5% having gone live in the UK and 2% in the US, according to AutoRek's survey. This early adoption signals a strategic advantage for these firms in offering faster and more convenient payment solutions to their customers, potentially gaining a competitive edge in the market.

Jan von Vonno, head of TPA's Open Banking Working Group, tells Payments Intelligence that the impacts of new open banking solutions across the UK and European markets are substantial. He says: "Looking closer at the UK, in the current economic climate, finding ways to financially support consumers is crucial. Fintech developments like sweeping variable recurring Payments (VRPs) provide people with greater visibility and control of their outgoing account-to-account transactions."

Von Vonno also observes the growth of commercial VRPs (cVRPs) in Europe, which he says "solve for fixed or variable recurring payments (beyond personal account transfers), and enable users to review or even cancel any subscription in a few clicks through their bank app, ensuring maximum transparency and control." He adds that this is crucial for improving financial health, helping vulnerable consumers avoid overdraft fees and cancelled payments amid the current economic environment.

In contrast to the opportunities presented by real-time payments and open banking, challenges associated with implementing new payment methods, understanding what the customer wants and compliance with new regulation and policy are perceived in the PAY360 survey to be significant barriers by industry professionals.

Despite the growing interest in cryptocurrencies and mobile payment solutions, concerns around regulatory compliance, cybersecurity, and consumer adoption may be tempering enthusiasm among payments professionals.

The data indicates that the looming issue facing the industry is, in fact, the challenge of introducing new payment methods, according to 12% of respondents. underscoring the importance of customer-centricity in the payments industry. Achieving a deep understanding of customer needs, behaviours, and preferences requires sophisticated data analytics capabilities and market research initiatives.

Compliance with new regulations and policies is a perennial challenge for payments firms, with 11% of respondents identifying it as a top concern. The regulatory landscape governing the payments industry is constantly evolving, driven by factors such as technological advancements, changing consumer behaviours, and global geopolitical developments. Brett Carr, associate, Latham & Watkins, says this was particularly evident last year, with payments sectors drawing increasing regulatory scrutiny. "Indeed, the need to deliver compliance with new regimes, such as the consumer duty in the UK, required a great deal of the firm’s attention and resources throughout the year", he says.

Perhaps surprisingly, only 7% of respondents identify financial security challenges as the most prominent despite increasing levels of financial crime. Streamlining backend infrastructure and processes (6%) and wider macro-economic downturns and shifts were identified as concerns for industry stakeholders.

The PAY360 survey includes individuals from 85 countries. The geographical data provides payment leaders with actionable-insights on the global dynamics shaping the future of payments.

The challenge of keeping up with digital transformation was prevalent across several countries, including Albania (100% of the country's respondents), Andorra (100%) and Malaysia (60%), among others. The findings spotlight the rapid pace of technological advancements reshaping the payments landscape globally, as opposed to some of the more well-known payments powerhouses such as the UK. Meanwhile, some countries, such as Brazil (29%), saw a lower percentage associated with this challenge; this could possibly indicate varied levels of digital infrastructure readiness or differing priorities in different regions.

Countries like Armenia (100%), Azerbaijan (100%) and Chile (100%) highlighted implementing new payment methods as a significant challenge. This recognition reflects the ongoing efforts of payment firms to adapt to evolving consumer preferences and technological innovations. The universal recognition of this challenge suggests that organisations face similar hurdles when integrating new payment methods into their existing systems, regardless of geographical location.

Respondents from Canada (36%), Columbia (67%), and Guernsey (100%) identified compliance with new regulations and policies. However, countries like Cyprus (38%), the Czech Republic (40%), and The Netherlands (39%) displayed lower percentages with this challenge, suggesting potential differences in regulatory environments or levels of regulatory scrutiny.

When it comes to financial crime and other cybersecurity threats, Qatar (100%) and the rest of the Middle East are notable for recognising this as a significant challenge, reflecting concerns about the increasing sophistication of financial crimes and cybersecurity threats.

TPA director general Tony Craddock believes this is due to the Middle East's strong growth in recent years.

He says, "The Middle East is booming for payments firms, where rising disposable incomes, increasingly sophisticated and technologically aware consumers, and government support have stimulated rapid growth."

Streamlining backend infrastructure and processes was selected by representatives from Finland (50%), the Philippines (50%), and Uruguay (33%) as the most significant challenge facing their industry, throwing emphasis on the importance of operational efficiency in driving business success. Conversely, some recipients based in Singapore (40%) showed relatively lower percentages with this challenge. This could point towards variations in infrastructure or, perhaps more significantly, differences in strategic priorities on that side of the globe.

Open banking emerges as the dominant opportunity identified by respondents in several countries across different continents, including Albania (100%), Andorra (100%), Colombia (100%), Iraq (100%), Isle of Man (67%), Moldova (67%), Thailand (33%). This demonstrates payments insiders' belief in the opportunity presented by open banking in reshaping the financial services landscape across the globe.

Cross-border payments are also identified as a significant opportunity in slightly more diverse regions, such as Denmark (100%), Iceland (50%) and Singapore (67%). This indicates the increasing demand for seamless international transactions amidst global economic integration.

In the same vein, the opportunity presented by real-time payments emerges as a key opportunity in countries like Armenia (100%), Kenya (40%), Nigeria (42%), and Rwanda (100%), indicating a growing emphasis on instant payment solutions to meet the evolving needs of consumers and businesses in some of the lesser developed parts of the globe.

On the subject, Craddock said, "There is growing interest in real-time payments because, quite simply, the near-instant clearing enabled by real-time payments is a better customer experience. It also opens the door to a flurry of new products and service features that are valuable to consumers."

Craddock adds that real-time payments are being adopted globally as a result of government pressure and consumer demand. He explains: "As a result of the success of criminals in getting consumers to authorise fraudulent push payments, new policies from regulators such as the UK’s Payments Systems Regulator allow firms sending and receiving payments to pause a payment if they think it could be fraudulent.

"It will only clear if it has the permission of the issuer of both the sending and receiving PSP. The certainty of real-time payments being ‘instant’ will disappear, as will user confidence in the certainty that a payment will go through. Come back cash; all is forgiven."

It is interesting to note that in some cases, respondents from the same country exhibited an alignment between both opportunities and challenges. For example, countries like Algeria, Iceland, and Mauritius identified cross-border payments as both a significant opportunity and challenge. This perhaps underlines the dual nature of international transactions as an opportunity for growth that comes with several pain points for businesses.

Leaders can leverage the data if looking to expand into new territories or optimise their operations in specific markets. Some countries for example, with a high percentage of respondents identifying open banking as an opportunity, may present fertile environments for collaboration and innovation in both banking and fintech.

PAY360 survey respondents deem open banking the primary topic of interest, with 3744 respondents (64%) selecting this option. The overwhelming interest in open banking possibly reflects the technology's benefits around developing innovative products and services, enhancing customer engagement, and driving operational efficiencies.

The number paints a similar picture when it comes to cross-border payments, ranking second, with 3472 (59%) respondents selecting it as the primary topic of interest. This could be attributed to the pressure payments firms are under to innovate and streamline their cross-border offerings as the demand grows for faster, cheaper and more transparent solutions.

Digital currencies (3079) and regulations (3079) ranked third as topics of interest. Interest in digital currencies has gained traction in the last decade, with the growing interest in stablecoin a particular example of this trend, which is reflected in a number of pilots operating across the globe.

Meanwhile, financial crime ranked fifth, with 2,602 respondents selecting it. Around 150 fewer respondents chose financial inclusion, ranking sixth, despite many regions across the globe still having significant portions of their populations underserved by traditional banking services.

The topic of ESG came in last, with only 1,756 survey respondents selecting it as their most important topic. Traditionally, payments leaders prioritise topics directly related to operational efficiency, innovation, compliance, and risk management. While ESG considerations are increasingly gaining prominence across various sectors, they may not yet be perceived as central to the core operations of payment firms compared to other topics such as financial crime, regulations, and cross-border payments.

As we distil insights from the PAY360 survey, it's clear that 2024 holds immense potential for innovation and growth within the payments industry despite the challenges ahead.

Artificial intelligence and cross-border payments are identified as significant opportunities, poised to drive business intelligence and facilitate smoother global commerce. However, the industry must also navigate critical challenges, including stringent regulatory compliance and escalating cybersecurity risks. The need for sophisticated data analytics to understand consumer behaviour further underscores the complex landscape leaders must traverse.

Looking ahead, our series will continue to explore the PAY360 survey findings, providing a deeper examination of the impacts and strategies across various sectors of the payments industry. We will also offer targeted insights tailored to different industry personas, such as C-suite executives, product managers, and regulatory bodies. This focused exploration aims to equip each segment of our audience with strategic knowledge, enabling them to effectively respond to the dynamic demands of the payments ecosystem.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

Development note: Shows when the article IS from Payments Intelligence, AND when a reader is NOT a member of TPA

Development note: Shows when someone IS logged in OR logged out AND we don’t know if they are a subscriber or a member (i.e. no Cookie “role” is set to “guest” and “is_subscriber” is “false”)

Development note: Shows when we know someone IS logged-out, IS a subscriber, but their role is NOT one of the member roles (i.e. Cookie “role” IS set to “guest, customer, non-member” and “is_subscriber” is “true”)

Development note: Shows when we know someone IS logged-out, IS a subscriber and IS a member (i.e. Cookie “role” is NOT set to “guest, customer, non-member” and “is_subscriber” is “true”)

Join The Payments Association and unlock a world of benefits:

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.